Designation Programs

The Institutes has redesigned the AAI designation program as of 2023. This designation is now only offered as an online virtual program. Earn your AAI after completing three focused courses and one ethics course. Arrange your courses around your schedule – with our 100% online delivery, our courses are accessible whenever you want, wherever you want.

AAI PROGRAM HIGHLIGHTS

- 3 courses, plus ethics

- 3-6 months to complete

- 100% online courses

- Virtual exams for all courses

- Mailed diploma upon completion

- Digital badge upon completion

AAI DESIGNATION REQUIREMENTS

To satisfy the designation requirements, you must pass all nine (9) courses in any order. There is no time limit to completing these courses.

- Ethical Decision Making in Risk and Insurance

- AAI 301: Becoming a Successful Insurance Agent

- AAI 302: Growing a Book of Business

- AAI 303: Understanding Coverage Solutions

HOW TO COMPLETE THE AAI COURSES:

Each course requires two steps to complete.

- Each student must purchase the materials and select an anticipated Exam Window

- Once you have completed the course modules and are ready to take the exam, you will need to purchase the exam separately to complete.

WHAT HAPPENS IF I’VE ALREADY TAKEN SOME AAI COURSES?

– Students who have passed AAI 81 A, B, and C will not have to take AAI 301.

– Students who have passed AAI 82 A, B, and C will not have to take AAI 302.

– Students who have passed AAI 83 A, B, and C will not have to take AAI 303.

SHOULD I GET MY AAI DESIGNATION?

This program is recommended for intermediate or advanced agency staff, including agents, brokers, agency principals, producers, account managers, and customer service representatives.

AAI ETHICS REQUIREMENTS:

All students must complete and pass either Ethical Decision Making in Risk and Insurance (for all programs except CPCU) or the Ethics and the CPCU Code of Professional Conduct for the CPCU programs. Both online modules are free.

Redesigned in 2024, the ACSR designation is now only offered as an online virtual program. Earn your ACSR after completing two core courses, three micro courses, and one ethics course. Arrange your courses around your schedule – with our 100% online delivery, our courses are accessible when you want, where you want.

ACSR PROGRAM HIGHLIGHTS

- 2 courses, 3 Micro-Certs, plus ethics

- 3-5 months to complete

- 100% online courses

- Virtual exams for all courses

- Mailed diploma upon program completion

- Digital badge upon program completion

ACSR DESIGNATION REQUIREMENTS

Two Core Courses:

Three Micro-Certs (select three):

- M-AB 123 Understanding Supplemental Personal Lines

- M-AB 131 Examining Workers Compensation Coverage

- M-AB 132 Understanding P&C Ratemaking and Pricing

- M-AB 133 Excelling at Account Management

- M-AB 134 Exploring Today’s Risk Management and Insurance Landscape

- M-AB 135 Closing Business Income Coverage Gaps

One Free Ethics Course:

HOW TO COMPLETE THE ACSR COURSES:

Each course requires two steps to complete.

- Each student will need to purchase the materials and select an anticipated Exam Window

- Once you have completed the course modules and are ready to take the exam, you will need to purchase the exam separately to complete.

The Agribusiness and Farm Insurance Specialist (AFIS®) continuing education program was developed to provide an opportunity for insurance agents, brokers, customer service representatives, and in-house risk managers or insurance buyers to gain specialized expertise in agribusiness and farm insurance and risk management. Completing the AFIS certification will ensure that the agent, broker, underwriter, or insurance purchaser understands the most important insurance needs of agribusinesses and farms. To obtain the AFIS certification, you must complete 5 specialized courses and then pass the corresponding on-line examination. After successfully passing all parts of the AFIS curriculum (with a minimum of 70% per exam) the student is awarded the designation.

AFIS COURSES:

- AFIS 1: Farm Property

- AFIS 2: Farm Liability

- AFIS 3: Farm Auto, Workers Compensation, and Umbrella Insurance

- AFIS 4: Special Farm Property Insurance Lines

- AFIS 5: Miscellaneous Farm Insurance Lines

THE AFIS CERTIFICATION ESTABLISHES EXPERTISE

The AFIS continuing education program was developed to provide an opportunity for insurance agents, brokers, customer service representatives, and in-house risk managers or insurance buyers to gain specialized expertise in agribusiness and farm insurance and risk management. Obtaining the AFIS certification will increase the competence, confidence, and credibility of insurance professionals who sell or underwrite insurance for agribusinesses and farms. Completing the AFIS certification will ensure that the agent, broker, consultant, or in-house risk manager or insurance purchaser understands the most important insurance needs of agribusinesses and farms. A client who buys insurance from an AFIS certification holder will know he or she is dealing with someone who is committed to the agribusiness industry. Agribusiness and farm insurance buyers who obtain the certification will have the knowledge to make wiser insurance and risk management decisions. Join the AFIS LinkedIn group or search the AFIS Broker Directory.

AFIS RE-ACCREDITATION

The core curriculum is composed of five basic- to intermediate-level insurance and risk management continuing education courses directly focused on the unique needs of agribusinesses and farms. Completing the core curriculum qualifies an individual to use the AFIS certification for 12 months. To maintain the certification, the AFIS certification holder must complete only 6 hours of AFIS continuing education credit every 12 months thereafter. Every third year, those 6 hours must be obtained by attending an Emmett J Vaughan Agribusiness Conference.

The Certified Insurance Counselor (CIC) Program is a nationally acclaimed continuing education designation program. Its course content and practical application make it the most essential program for both agency and company personnel.

The designation is earned by attending five intensive CIC Institutes: Agency Management, Commercial Casualty, Commercial Property, Life & Health, Personal Lines, and passing the comprehensive essay examination that follows each institute.

You have a period of five years to take and pass all five parts. The state requires that all registrants attend a class in its entirety to receive continuing education credits (CEUs). Partial credit is not given for partial attendance. LATE ARRIVALS WILL NOT RECEIVE ANY CEUs.

The CISR program is a practical program that stresses the understanding and analysis of risks and exposures. Students of this program should have a basic knowledge of insurance.

CISR DESIGNATION CLASS REQUIREMENTS

The CISR designation consists of 5 one-day courses covering key areas of a CSR’s daily work.

Available Courses (choose any 5):

- Agency Operations

- Commercial Casualty I

- Commercial Casualty II

- Commercial Property

- Personal Auto

- Personal Residential

- Personal Lines Miscellaneous

- Life & Health Essentials

- Elements of Risk Management

Requirements to Earn the Designation:

- Complete any 5 of the 9 courses.

- You may take the courses in any order.

- Each course is followed by a one-hour exam. To earn the designation, you must pass all 5 exams.

- Anyone may attend courses for CEUs only without taking the exam.

To earn the CISR designation, you must successfully complete the program and pass the exams within three calendar years following the passage of the first exam. The state requires that all registrants attend a class in its entirety to receive continuing education credits (CEUs). Partial credit is not given for partial attendance. LATE ARRIVALS WILL NOT RECEIVE ANY CEUs.

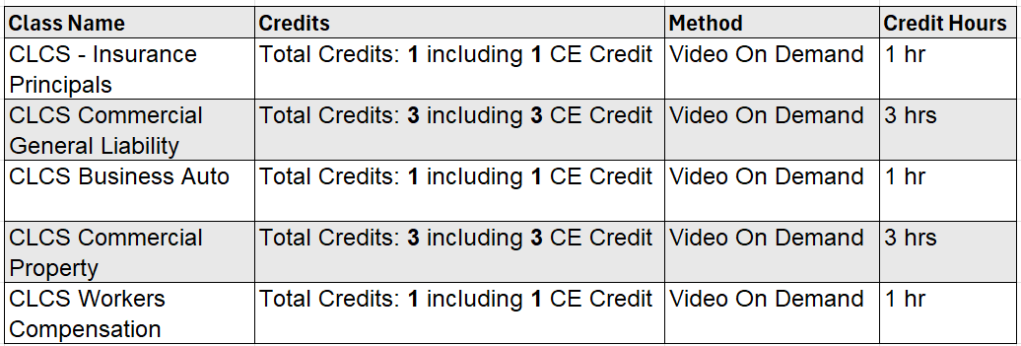

The CLCS Specialist program offers essential knowledge for those starting their careers in the insurance industry, covering fundamental principles in a user-friendly format. It encompasses key areas such as commercial auto, general liability, commercial property, and workers’ compensation, providing a solid foundation for understanding complex insurance concepts. Designed to bridge the gap between entry-level and advanced roles in underwriting and claims, the CLCS designation enables students to quickly apply their learning in real-world scenarios. Unlike many other designations, there are no annual updates required once the designation is earned, making it a convenient and efficient choice for aspiring insurance professionals.

CLCS PROGRAM HIGHLIGHTS

⭐ PLEASE NOTE – ONCE YOU EARN THIS DESIGNATION, NO ANNUAL UPDATES ARE REQUIRED! ⭐

The CLCS Specialist program is designed to provide fundamental knowledge necessary to begin working in the insurance industry. It covers insurance principles, commercial auto, general liability, commercial property, and workers’ compensation in a readily digestible, easy learning format.

The insurance industry is complex, and education is the key to understanding its various concepts and applications. The CLCS provides key foundational knowledge in a reasonable amount of time with a focus on training those new to the industry so that they can quickly become competent in their positions.

It is designed to ready the entry-level student to be able to apply what they have learned in real-world scenarios quickly and help the student become well-versed in the main aspects of the commercial world of insurance.

By focusing on industry and commercial concepts, the student is able to move into a competency level that would otherwise take years using a more traditional approach.

The CLCS designation bridges the knowledge gap between entry-level and advanced roles in underwriting and claims. The program focuses on foundational learning, ensuring students understand and can practically apply comprehensive concepts, enabling them to confidently assume a functional role within an agency or carrier.

How to get my Designations:

1. Purchase CLCS package through ABEN.

2. After purchase and prior to beginning the actual designation coursework, you will gain access to the NO CE Training Materials, which will serve as an important resource as you move through the program.

3. Next, begin the actual designation coursework and access the comprehensive eBook and online study materials (PDF). If you prefer a hard copy of the textbook, you may request one by contacting our NU representative. You can expect four guidebooks; Insurance Principles is available online only. These materials will serve as invaluable resources throughout your insurance career.

4. After successfully completing each of the five sessions, you must pass an exam with a minimum score of 70%. Once all five classes and their corresponding exams are completed, an overall system certificate will be awarded. At that time, you may contact our NU representative to receive your official CLCS Designation Certificate.

The AIMS Society’s Certified Professional Insurance Agent (CPIA) Designation is the first-of-its kind, hands-on, how-to training. These seminars are designed to enhance the ability of producers, sales support staff, and company personnel to efficiently create and distribute effective insurance programs. Participants leave with ideas that will produce increased sales results immediately.

BENEFITS:

- Enhance the ability to efficiently create and distribute effective insurance programs.

- Learn ways to increase sales

- Broaden your organization’s market reach

- Learn to deliver customer experiences that drive increased retention

SHOULD I GET MY DESIGNATION?

This program is recommended for intermediate or advanced agency staff, including agents, brokers, agency principals, producers, account managers, and customer service representatives.

DESIGNATION REQUIREMENTS:

To earn the CPIA designation, candidates are required to participate in a series of three, one-day Insurance Success Seminars – Position for Success, Implement Success, & Sustain Success.

MAINTAINING THE CPIA DESIGNATION:

After completion of the three Insurance Success Seminars, you must attend an update annually. This update requirement can be satisfied through participation in any one of the three core Insurance Success seminars, participation in any one of the Advanced Insurance Success seminars, or by maintaining individual or group membership in AIMS.

The Construction Risk and Insurance Specialist (CRIS) program is a specialized curriculum focusing on the insurance and risk management needs of construction projects and contractors. Those who complete the program are entitled to display the CRIS certification to certify their knowledge of construction insurance and risk management and dedication to the industry. To obtain the CRIS certification, you complete 5 specialized courses on construction risks and insurance and then pass the corresponding online examination. After successfully passing all parts of the CRIS curriculum (with a minimum of 70% per exam), the student is awarded the designation.

COURSES:

- Commercial Auto, Surety, CIPs, and Misc. Lines

- Commercial Liability Insurance for Contractors

- Contractual Risk Transfer in Construction

- Property Insurance for Contractors

- Workers Compensation for Contractors

THE CRIS CERTIFICATION ESTABLISHES CREDIBILITY AND DEDICATION

The insurance needs of contractors are quite complex, and insurance generalists frequently make errors in designing programs for their clients. The CRIS program was developed by IRMI in response to concerns expressed by many contractors. Completing the CRIS curriculum will ensure that the agent, broker, consultant, or in-house risk manager or insurance purchaser understands the most important insurance needs of contractors. The program also establishes the individual’s commitment to the construction industry with a mandatory continuing education component focusing on construction risk and insurance. When dealing with a holder of the CRIS certification, a contractor will know that this person possesses at least a basic-to-intermediate understanding of construction exposures, insurance, and risk management techniques, and that the person is making an effort to stay on top of insurance industry changes and trends affecting contractors.

CRIS RE-ACCREDITATION

Upon earning your CRIS certification, you must engage in an ongoing continuing education process to maintain it. This involves obtaining 7 hours of approved construction risk and insurance continuing education credit during the 12 months following initial receipt of the certification and every 12 months thereafter. You may obtain this CE credit by attending approved CRIS courses or conferences or completing online CRIS courses.

The Management Liability Insurance Specialist (MLIS) program is composed of a specialized curriculum focused specifically on Directors and Officers (D&O) liability, employment practices liability (EPL), and fiduciary liability insurance. Those who complete the program are entitled to display the MLIS certification to certify their knowledge of management liability insurance and risk management.

To obtain the MLIS certification, you must complete 5 specialized courses and then pass the corresponding online exam. After successfully passing all parts of the MLIS curriculum (with a minimum of 70% per exam), the student is awarded the designation.

COURSES:

- Cyber and Privacy Liability Exposures

- EPL: Understanding the Exposures and Insurance Coverage

- Fiduciary Liability: What You Need to Know About Exposures and Insurance

- How to Insure E&O Liabilities

- Understanding D&O Exposures

THE MLIS CERTIFICATION ESTABLISHES CREDIBILITY AND DEDICATION

Management liability exposures and coverages are quite complex, and insurance generalists frequently make errors in designing programs for their clients. Thus, IRMI developed the MLIS program in response to concerns expressed by clients about the difficulty of determining whether their insurance agents, brokers, and other risk advisers have the specialized knowledge necessary to properly design and arrange their insurance programs. Completing the MLIS curriculum will ensure that the agent, broker, consultant, or in-house risk manager or insurance buyer understands the most important aspects of professional and management liability. The program also establishes the individual’s commitment to the industry with a mandatory continuing education component focusing on professional and management liability insurance. When dealing with a holder of the MLIS certification, a buyer will know that this person possesses at least a basic-to-intermediate understanding of management liability exposures, insurance, and risk management techniques and that the person is making an effort to stay on top of relevant insurance industry changes and trends.

MLIS RE-ACCREDITATION

Upon earning your MLIS certification, you must engage in an ongoing continuing education process to maintain it. To maintain the MLIS certification, you must obtain 3 hours of approved professional or management liability insurance continuing education credit during the initial 12 months and every 12 months thereafter (generally one online course or a half-day of seminar attendance).

MAIA has developed a high-caliber educational curriculum for serious insurance agency professionals seeking to pursue a premier designation: Accredited Insurance Lines Professional (AILP).

Everyone is eligible to earn the AILP designation.

AILP designations are available at three levels – the complete designation, which covers both Personal and Commercial Lines, and two monoline options:

- AILP – Accredited Insurance Lines Professional (Complete designation including PL & CL)

- AILP/PL – Accredited Insurance Lines Professional / Personal Lines only

- AILP/CL – Accredited Insurance Lines Professional / Commercial Lines

PROGRAM HIGHLIGHTS

- There are two levels of AILP classes – Personal or Commercial

- Coverage classes offer intermediate content

- Issues classes dive deeper into the more complicated scenarios.

- Choose webinars or live classroom learning

- A wide variety of classes can fulfill the yearly renewal requirement

- Class exemptions if you already have certain designations

COURSE REQUIREMENTS

⭐ Learn more about the AILP courses here ⭐

AILP/Personal Lines

Anyone pursuing the AILP or AILP/PL designation must complete these courses (unless exempt). Each course has a one-hour essay exam at the end of the day, centered on the material presented that day.

- AILP Coverage: Homeowners

- AILP Coverage: Massachusetts Personal Auto

- AILP Issues: Personal Residential Part 1

- AILP Issues: Personal Residential Issues Part 2

- AILP Issues: Miscellaneous Personal

- AILP Issues: Personal Auto Part 1

- AILP Issues: Personal Auto/Umbrella Part 2

AILP/Commercial Lines

Anyone pursuing the AILP or AILP/CL designation must complete these courses (unless exempt). Each course has a one-hour essay exam at the end of the day, centered on the material presented that day.

- AILP Coverage: Commercial Auto

- AILP Coverage: Commercial General Liability

- AILP Coverage: Workers’ Compensation

- AILP Coverage: Commercial Property

- AILP Issues: Commercial Liability Part 1

- AILP Issues: Commercial Liability Part 2

- AILP Issues: Commercial Property

- AILP Issues: MLIS EPL Understanding the Exposures and Insurance (IRMI course)

- AILP Issues: MLIS Cyber and Privacy Liability Exposures and How to Insure Them (IRMI course)

SHOULD I GET MY DESIGNATION?

AILP courses are appropriate for Agency Producers, Account Managers, CSRs, Underwriters, Adjusters, or any insurance agency employee who wants to build a solid practical knowledge base to facilitate their career performance and advancement. Participants should have at least two years of experience in insurance and have completed beginners’ insurance courses in the coverage topics (or have a producer license).

The AILP curriculum includes both Coverage* and Issues** Courses. The complete designation (AILP) requires successful completion of all Coverage PL and CL Courses AND all Issues PL and CL Courses. A monoline designation (AILP/PL or AILP/CL) requires successful completion of all Coverage and Issues Courses in the desired line. Specific coursework completed for other designations or certifications may count toward your AILP designation

DESIGNATION REQUIREMENTS

To earn the complete AILP designation, you must complete all courses in either the personal lines or commercial lines track. (See below for exemptions.) When taking both PL and CL courses at the same time, all required coursework must be completed within six (6) years. To earn a monoline designation (either AILP/PL or AILP/CL), all required coursework must be completed within four (4) years. Once an AILP designation has been obtained, you can immediately use the designation. You may obtain one monoline designation first and then add on the other to reach the complete designation.

AILP Course Exemptions

Coursework from other insurance certifications or designations may count toward your Accredited Insurance Lines Professional (AILP) designation. If you hold the AAI: Accredited Adviser in Insurance, CIC: Certified Insurance Counselor, or CISR: Certified Insurance Service Representative designation, all AILP Coverage classes can be waived.

CISR: Certified Insurance Service Representative ….. ALL AILP Coverage classes

AAI: Accredited Adviser in Insurance …………………….. ALL AILP Coverage classes

CIC: Certified Insurance Counselor ………………………… ALL AILP Coverage classes

MLIS: Management Liability Insurance Specialist …… MLIS EPL Understanding the Exposures and Insurance Coverage AND MLIS Cyber and Privacy Liability Exposures and How to Insure Them

Designation Updates

To retain the ability to utilize the designation, the designee must perform a yearly (calendar year) update which can include any multi-day, full-day, or 2 partial-day courses that total at least six (6) continuing education (CE) credits; that are intermediate to advanced in nature (i.e., programs that discuss policy issues, not those that just review policy coverages*); and offered through MAIA.

*Examples of Qualifying Renewal Classes

For AILP/CL designees, the renewal course must be in commercial lines. For AILP/PL designees, it must be in personal lines. If you have earned the complete AILP designation, your renewal course can be in either commercial or personal lines.

- AILP Issues Programs (but NOT AILP Coverage Programs)

- Homeowners Issues (but NOT Homeowners Coverage)

- Deep Dive Into WC (but NOT Workers Compensation Coverage)

- CIC-Ruble Graduate Seminars (but NOT CIC Institutes)

- CISR-William T. Hold [WTH] Seminars (but NOT CISR Classes)

- MLIS Programs (but NOT AAI Programs)

When registering for a program for designation renewal, please indicate “AILP Renewal” next to your name. If it is a virtual class, please email the Education Team Member for that class and inform them of your renewal intentions. If unsure, please contact MAIA’s Education Team prior to the class.

Exam Information

On the day of the exam, you will receive an email with exam access information and a downloadable Affidavit form. Prior to taking the exam, please review the Affidavit and fill out the top of the form. The proctor will then need to complete and sign the bottom of the form.

The online exam will open at 3:30 PM on the day of the class, and close at 3:30 PM the following day. You may take it any time within that timeframe, but once you start, you will have 60 minutes to complete it.

You will need to have a disinterested third-party proctor to monitor you while taking the online exam and sign an affidavit.

VIAA Designation Programs

Your staff can demonstrate their commitment to professional development by pursuing one of the many prestigious designation programs available through VIAA.

For questions, contact Sarah Ribera at sarah@viaa.org or 1-844-609-1481.

⭐ Members receive 10% off all Institutes’ online content with the discount code BIGIVT10 ⭐